Researcher: Small Tshithavhana, University of the Witwatersrand, Johannesburg

Supervisor: Dr. Walter Mudzimbabwe, University of the Witwatersrand, Johannesburg

Financial forecasting has become increasingly important in today’s global market due to its ability to

assess risk and inform decision-making. However, accurately forecasting financial markets is challenging

due to their stochastic nature and complexity. To address this challenge, we suggest a state space

model, namely the Hidden Markov Model, which handles dynamic time series issues involving unseen

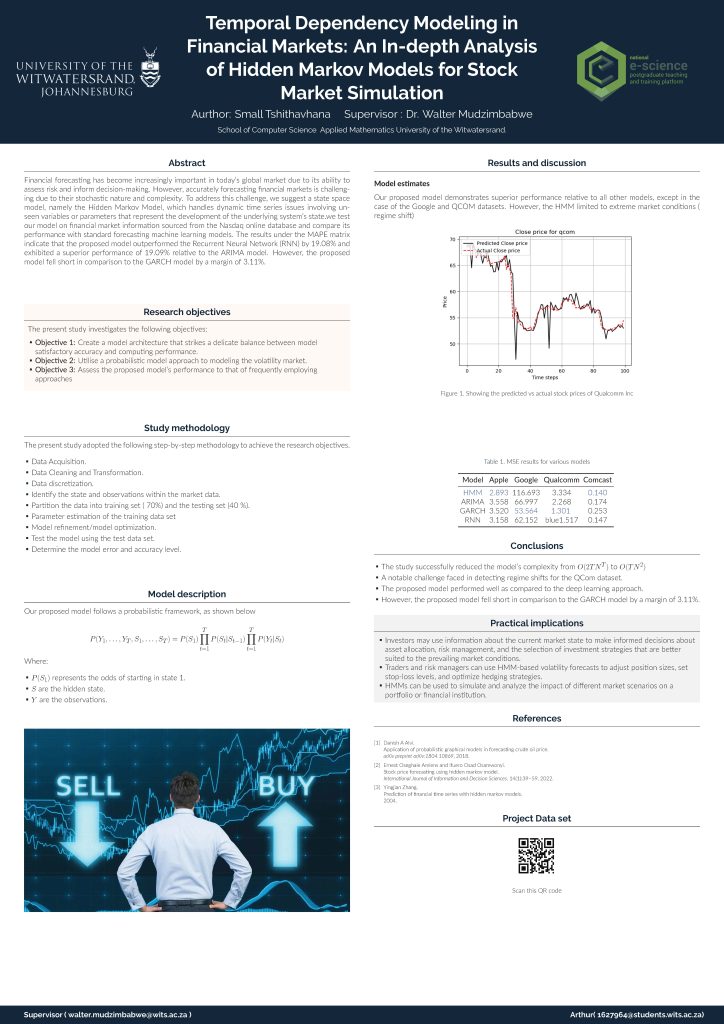

variables or parameters that represent the development of the underlying system’s state.we test

our model on financial market information sourced from the Nasdaq online database and compare its

performance with standard forecasting machine learning models. The results under the MAPE matrix

indicate that the proposed model outperformed the Recurrent Neural Network (RNN) by 19.08% and

exhibited a superior performance of 19.09% relative to the ARIMA model. However, the proposed

model fell short in comparison to the GARCH model by a margin of 3.11%.